Losing money in the stock market is emotionally painful. When markets go down, the stress created by falling prices affects our confidence, mindset, and even our ego. Accepting losses is difficult because it feels like we made a mistake with our hard-earned money.

But losses are a normal part of investing and trading. Every successful trader or investor has faced losses at some point. What matters is how you understand those losses and how you respond to them.

In this article, we will clearly explain the different types of losses in the stock market and share practical ways to deal with them so you can become a more disciplined and confident trader.

Why Losses Feel So Painful in the Stock Market

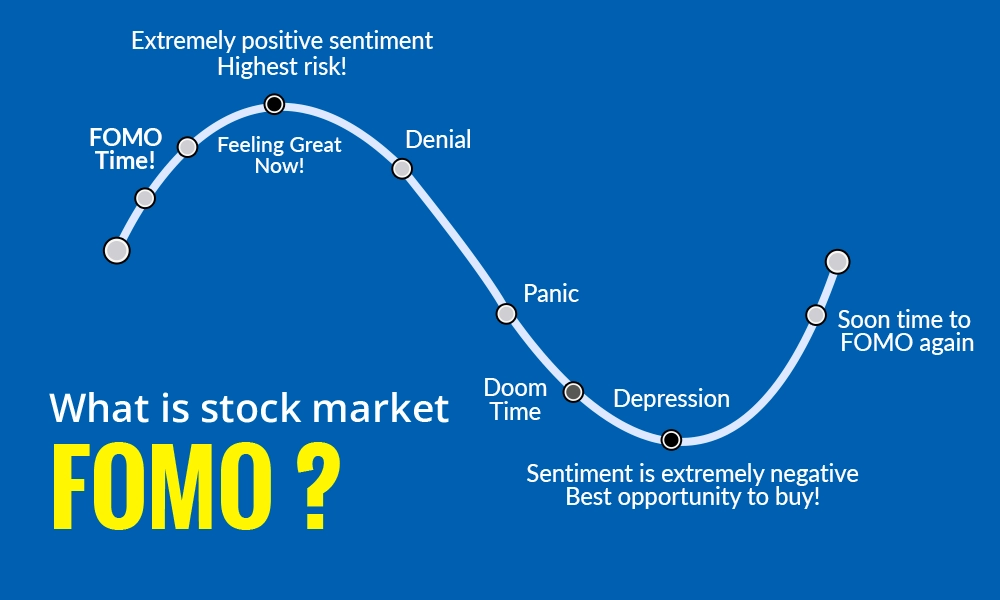

Everyone invests with the hope of creating wealth. When stock prices rise, we feel happy and confident looking at our portfolio. But when the market enters a downturn, fear and anxiety take control.

It is emotionally very difficult to watch your portfolio value fall. No one likes losing money. This emotional pain often leads to panic decisions like selling at the wrong time or avoiding the market completely.

The first step to dealing with losses is to identify what type of loss you are facing.

Different Types of Losses in the Stock Market

There are mainly three types of losses that investors and traders experience.

1. Capital Loss

Capital loss is the most common and painful type of loss.

You buy a stock, and the price starts falling. Due to stress and fear, you decide to sell the stock at a lower price than what you paid. The difference between your buying price and selling price is called capital loss.

Example:

You invest ₹10,000 in a stock.

The price falls by 20%.

You sell it at ₹8,000.

Your capital loss is ₹2,000.

In most portfolios, more than 90% of losses are capital losses caused by emotional selling.

How to Manage Capital Loss

You must clearly understand the difference between unrealized loss and realized loss.

-

If your stock price falls but you do not sell, it is an unrealized loss

-

A loss becomes real only when you sell the stock

Markets move in cycles. If the company fundamentals are strong, prices may recover over time. Panic selling during temporary market corrections often turns paper losses into permanent losses.

👉 Always remember:

Unrealized loss is not the same as realized loss.