The stock market is full of stories — some inspiring, some cautionary. But most investors do not fail because they lack opportunities. They fail because they want to become rich quickly.

The market is not designed for overnight success. It rewards patience, consistency, and most importantly — starting early.

If wealth creation is your goal, the timing of your first investment matters far more than timing the market itself.

Power of Being Early in the Game

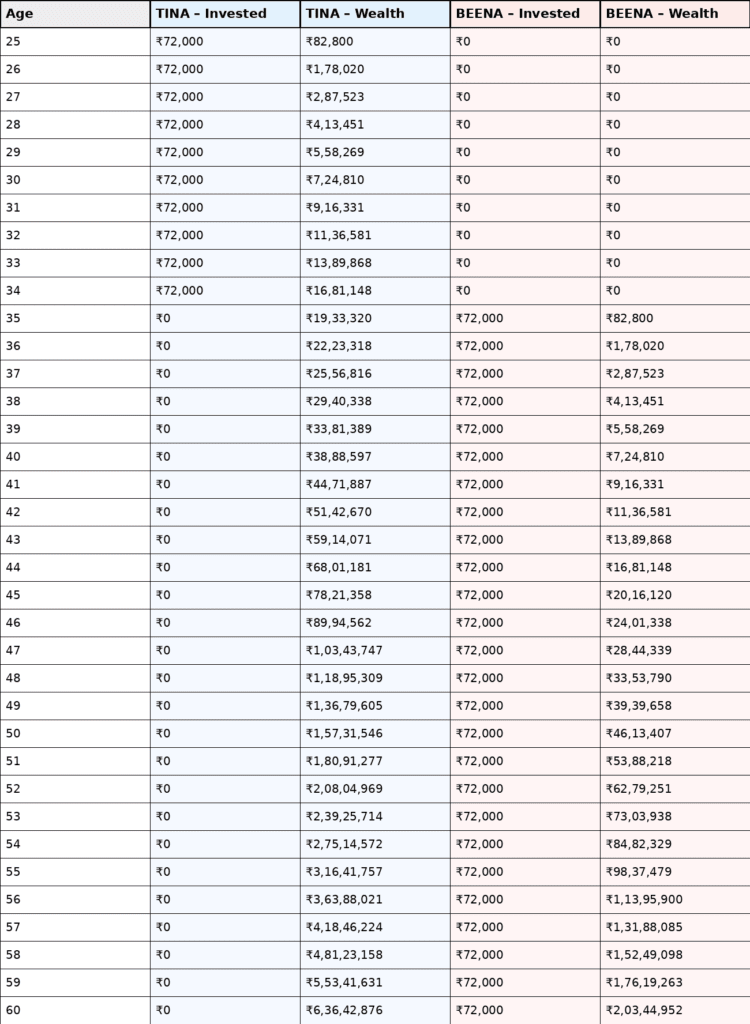

Tina and Bina, two childhood friends, begin their careers at age 25 with a salary of ₹20,000/month. Their investing decisions, however, are very different.

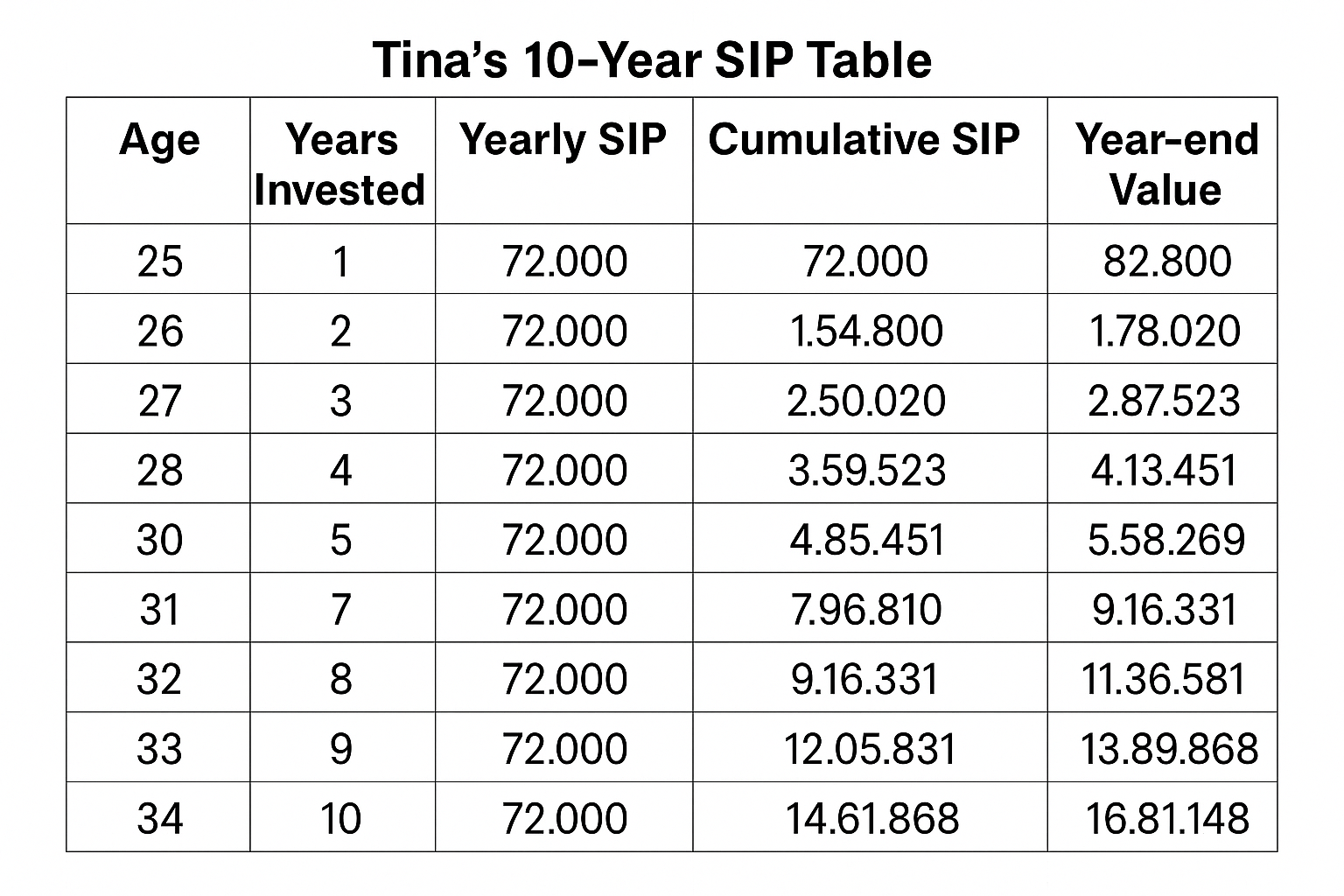

Tina’s Early Start

-

Invests ₹6,000/month

-

Duration: 10 years (age 25–34)

-

Stops investing at 35

-

Expected return: 15% per year

-

Total invested: ₹7.2 lakhs

Bina’s Late Start

-

Begins investing at age 35

-

Invests ₹6,000/month

-

Duration: 25 years (age 35–60)

-

Expected return: 15% per year

-

Total invested: ₹18 lakhs

Who Becomes Wealthier?

Surprisingly — Tina becomes nearly 4X wealthier despite investing less money for fewer years.

Why?

Because Tina gave her money something priceless:

Time to compound.

Tina’s 10-Year SIP Table

Long-Term Wealth Comparison — Tina vs Bina

Result Summary

-

Tina: ₹7.2 lakh invested → ₹8.33 crore

-

Bina: ₹18 lakh invested → ₹2.03 crore

Bina can NEVER catch up — because time cannot be replaced.

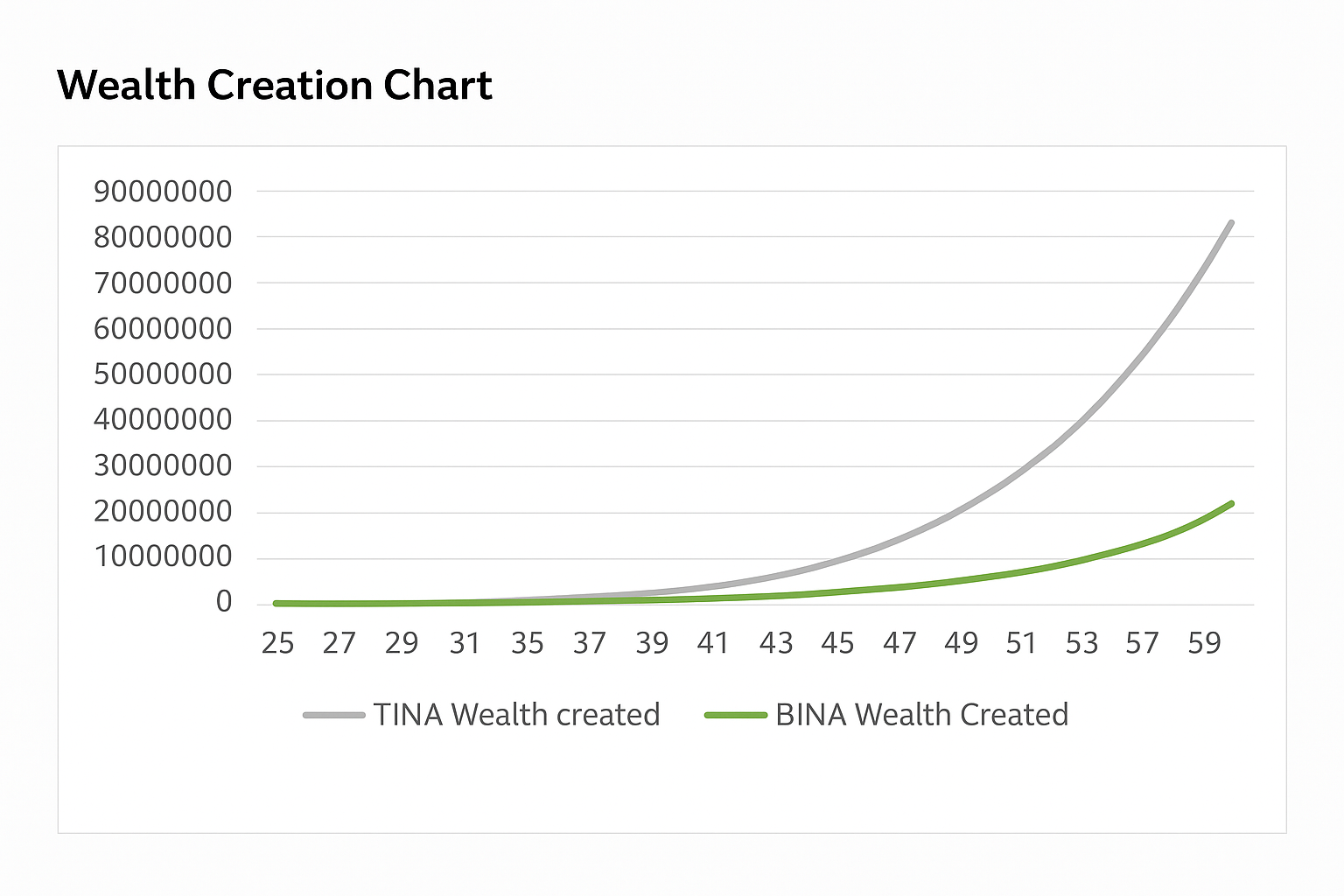

Wealth Creation Chart

This chart visually shows how Tina’s early start causes her wealth to accelerate exponentially after age 40.

If You Didn’t Start Early — When Should You Start?

Most beginners ask:

“What is the right time to start investing?”

The answer is:

The Best Time Is NOW.

Do NOT wait for:

-

Better economic conditions

-

A market crash

-

Salary increase

-

Political clarity

Today’s market news — inflation, rupee volatility, elections, global tensions — will fade in a year or two.

But lost compounding years will never return.

Start where you are, with what you have.

Warren Buffett’s Greatest Regret

Buffett famously said:

His wealth is built on decades of compounding — not shortcuts.

Final Thoughts

The stock market is not a shortcut. It is a powerful wealth-creation tool for those who:

-

Start early

-

Stay invested

-

Avoid noise

-

Trust compounding

You cannot control the market —

but you can control when you begin.

And the best time is always today.