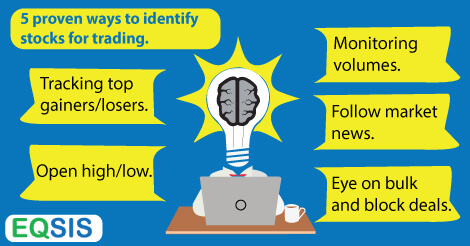

7 Proven Ways to identify stocks for trading

For any stock trader timing the market is challenging. Every trader wants to make money, but to become successful you need to find ways to identify stocks that will make money. There are thousands of stocks traded daily and it is not possible to study each stock. Let’s find the proven ways to identify stocks.

-

Track top gainer and losers

A stock trader uses these terms very often as it is trustworthy to identify stocks for both positional and intraday trading. The stock identified based on this indicator is generally backed by good momentum. If the same stock is repeatedly spotted in the leader board then this indicates trader’s interest in identified stock. You can go ahead and finalize the stock for trading.

-

Look at open high / open low

This indicator is familiar among the intraday traders. A stock opening high and if continues to climb higher levels, then this indicates the presence of aggressive buyers in the market. This positive sentiment indicates bullish trend. You can trade this stock by keeping the day’s low as stop-loss. Positional traders can track the stocks which are closed above previous day’s high for long positions and any stock closed below the low can be qualified as weak.

-

Monitor volume of trades

For any technical breakout, volume is the key. Hence we can sort stocks based on the volume parameters such as increase in volume, surge in volume, and decrease in volume for further analysis.

Below things are generally conveyed by volume,

-

Increases in volume – confirmation for breakout.

-

Surge in volume (unusual increases) – a sign of reversal.

-

Decreases in volume – loss of momentum.

Note: It is generally recommended to trade stocks which are highly liquid. Stay with Top 100 or 200 companies.

-

-

Note market news

News impacts the market price, though it is not directly correlated. Sometimes positive news impacts the market negatively. To understand the market impact you need to watch the stock charts in relation with the market news. This will help you find correct stocks for trading. News such as corporate action bonus, dividends, rights, etc and corporate announcements such as earning results, M&A, legal proceedings, approval, new project and other announcements can make the stock come into lime light. Identifying such stocks can help you make some money if you understand the trend and take correct decisions.

-

Observe the change in open interest

The derivative market enables the traders to leverage position on both the direction with limited margin. The open interest build up along with change in price could give an indication to understand their stance.

-

Fresh Long = Increases in open interest + Increases in price.

The Stock with fresh long indication can be considered for accumulations.

-

Fresh Short = Increases in open interest + Decreases in price.

The Stock with fresh short indication can be considered for creating short positions.

-

Long Unwinding = Decreases in open interest + Decreases in price.

The Stock with Long Unwinding indication which is breaking its crucial support zone can be used to make short trades. Otherwise it can be used to exit our long position if any.

-

Short Covering = Decreases in open interest + increases in price.

The stock with short covering indication which breaking its crucial resistance zone can rally further in next few sessions; it is due to unwinding pressure. Short covering along with increases in premium indicates panic buying in market.

-

-

Watch on relative performance

Stocks with strong buyers are expected to outperform the broader market if it consistently performs well in the various time periods like, day, week and month. This indicator can help you in spotting good stocks which are outperforming the market; you can consider these stocks during bullish trend reversal in broader market. The stocks which are consistently under-performing the market is considered as weak, hence you can use this for short positions.

-

Eye on bulk and block deals

Have you ever thought of finding the activities of stronger hands? Who are these people? What do they trade? How much do they buy/sell? What was the trade price? The deal made by stronger hand is one of the simplest ways to understand the market trend. The summary of bulk and block deals helps us to recognize the top buyers, seller and the stock they bought along with the prices.

Knowing the art of picking stocks would tremendously increase the success ratio. NSE Stock Screener helps you to filter and identify stocks for trading based on technical indicators. Before using any of the scanners try understanding the character and benefits of using such scanner. Some of them are really useful only for intraday traders and some could benefits the positional traders too.