1. Great Business

Great businesses have an enduring economic moat, meaning a strong long-term competitive advantage that protects their profits.

These companies usually grow at a moderate pace, but the key point is that they require very little additional capital to grow. They generate large amounts of cash and deliver consistently high returns on invested capital (ROIC).

Key Traits of a Great Business

-

Asset-light business model

-

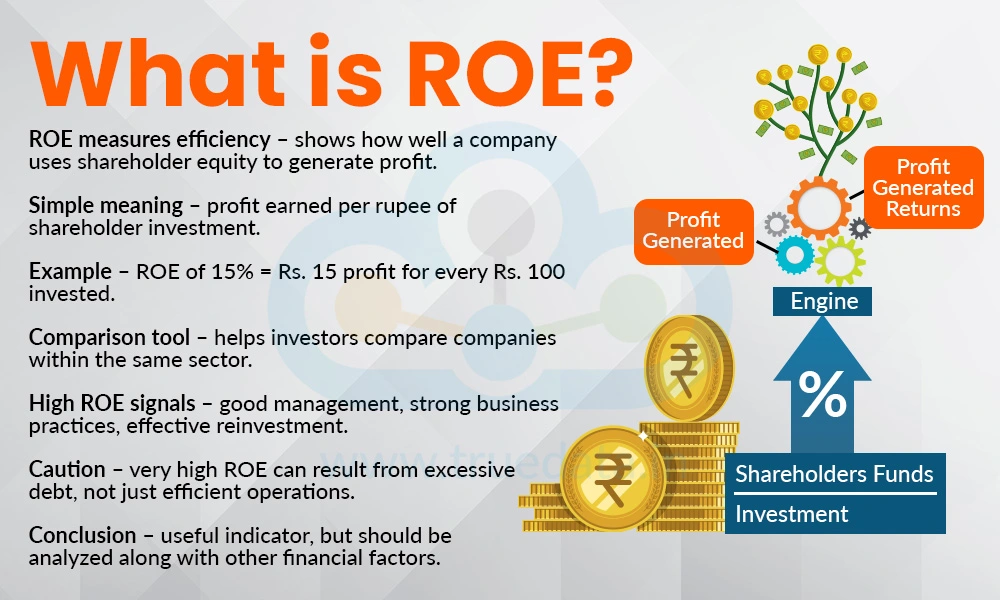

High and increasing ROE

-

Strong pricing power

-

High dividend payouts

-

Very low or no debt

-

Sustainable competitive advantage

Example: Nestlé India Ltd

Nestlé India is a classic example of a great business.

Over the years, Nestlé required less capital to operate, while its profits kept increasing steadily. In some years, it even reported negative invested capital, which means the business generates enough cash internally to fund its growth.

👉 This is the hallmark of a great business:

Less capital + higher profits = wealth creation

2. Good Business

Good businesses grow at healthy rates, but they need regular capital investment to sustain that growth. Unlike great businesses, they must reinvest a significant portion of profits—and sometimes raise additional capital.

These companies still create value, but at a slower pace.

Key Traits of a Good Business

-

Capital-intensive model

-

Stable but moderate ROE

-

Lower pricing power

-

Reasonable dividend payout

-

Requires good management to perform well

Example: Balkrishna Industries Ltd

Balkrishna Industries needed to invest capital every year to grow its operations. As invested capital increased, profits also grew.

In good businesses:

-

Profit growth is directly linked to capital invested

-

ROIC is usually higher than the cost of capital

👉 Good businesses can still be rewarding investments, especially when bought at the right price.

3. Gruesome Business

Gruesome businesses are the most dangerous for investors.

These companies generate returns lower than their cost of capital, meaning they destroy value even if revenues grow. Many such businesses require heavy reinvestment but fail to generate meaningful profits.

Key Traits of a Gruesome Business

-

Low or negative ROE

-

Poor or no pricing power

-

High capital requirements

-

Little or no dividends

-

Highly cyclical in nature

Example: Tata Global Beverages (Earlier Phase)

Despite generating profits in some years, Tata Global Beverages delivered returns lower than its cost of capital. This means that even growth did not benefit shareholders.

👉 Important lesson:

All growth is not good growth.

If returns are lower than the cost of capital, growth destroys value.

A Simple Bank Account Analogy

Think of businesses like three bank accounts:

-

Great Business – A bank account that pays very high interest and increases rates every year

-

Good Business – A bank account with decent interest, but you must keep adding money

-

Gruesome Business – A bank account with poor interest where you keep depositing but gain little

👉 Smart investors avoid the third account completely.

Summary – How Investors Should Think

Characteristics of a Great Business

-

Needs very little money to grow

-

High and rising ROE

-

Strong pricing power

-

Asset-light model

-

High competitive advantage

Characteristics of a Good Business

-

Needs capital for growth

-

Moderate pricing power

-

Stable ROE

-

Requires strong management

Characteristics of a Gruesome Business

-

Returns lower than cost of capital

-

Capital-hungry with weak profits

-

Value-destroying growth

-

High risk for long-term investors

Final Thoughts for Investors

Instead of spending time only finding great businesses, investors should first avoid gruesome businesses.

If you successfully avoid value-destroying companies, 90% of your investment job is already done.

At EQSIS, we help investors and traders understand business quality, financial fundamentals, and long-term value creation so they can make smarter decisions in the stock market.