Is The Dream Run For Asian Paints And Berger Paints Over?

If you have invested Rs 1 lakh rupee in Asian paints 15 years ago, your money would have multiplied nearly 35 times. Shareholders of Asian paints had a dream run in share price in the last 10-15 years. But the bad news is that this may not continue in the coming years.

The Concentration of Industry Profit

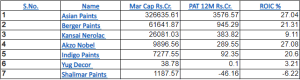

Nearly 86% of the paint industry’s profit is earned by only two players (Asian Paints and Berger paints). Asian paints alone contribute nearly 68% of industry profits and Berger paints contribute nearly 18% of industry profit.

The total revenue of the paint industry stands at Rs 52000 Cr in FY22. The cumulative profit earned by all the players stands at Rs 5241 Cr. The market value of the paint industry is around Rs 4.3 lakh cr. Industry PE is around 90x.

One of the main reasons why companies in the paint industry are trading at high valuations is because of their high ROC. The Return on capital of the paint industry is around 22%. As a rule of capitalism, a high ROC industry will naturally attract new players into the paint market.

Entry Of New Players

Recently Aditya Birla group and JSW group have shown their interest in the paint industry by announcing that, both of them cumulatively going to invest Rs 10000 Cr in the next 2-3 years. This equals nearly 43% of existing capital in the paint market. This will indirectly affect the ROC of the existing player.

New players may not be able to take market share easily from Asian Paints and Berger Paints, but intense competition will result in a marginal reduction of the ROC of Asian Paints going forward. This will directly affect the premium valuation of Asian paints. The market has given superior status to Asian paints because of its inevitable market position. Indigo paints and JSW paints may challenge this inevitable nature of Asian paints.

Low Expectations from The New Players

The main thing we must keep in mind is that new players (Indigo paints and JSW paints) are not competing with Asian paints to get ROC of 30%+ for their business. Their expectation is just only 12-15%. Since their expected return is less, they can easily penetrate deep into the paint industry and disrupt the existing player. Thereby reducing the growth rate and ROC of the existing player. Both companies have strong parentage, so the availability of money to new players is not a big problem.

You can watch out our video of Asian paints: You need to know why PE of Asian Paint may come down in few years