The tactics for making consistently good investment decisions often feel like an unsolved mystery. In reality, good decision-making isn’t about predicting the future perfectly — it’s about developing a thoughtful process that evaluates problems clearly and weighs possible outcomes sensibly. As Charlie Munger once said, “It’s better to be roughly right than precisely wrong.”

Investing is not a world of certainties — it’s a probabilistic science. Since we operate in probabilities, not guarantees, the true edge lies not in forecasting outcomes but in building a disciplined, repeatable investment decision making process.

Why Good Investment Decisions Are So Hard

Every investment decision we make competes against two powerful forces:

1. Future Uncertainty

We simply cannot predict all future states of the market or assign precise probabilities to them.

We can reduce uncertainty — but never eliminate it.

2. Human Emotion and Behavioral Biases

Investors are emotional creatures trying to make rational decisions in an irrational world.

Fear, greed, overconfidence, anchoring — these distortions cloud judgment and push us away from logic.

Because of this, the smarter question isn’t:

“How do I make good decisions?”

Instead, invert it:

The Real Question — How Not to Make Bad Decisions

Both questions sound similar, but the shift in perspective is enormous.

When you actively work to avoid the predictable mistakes, your decision-making automatically improves.

The first step is to understand the environment in which a decision exists.

Risk vs Uncertainty — Your First Filter in Clear Decision-Making

Most investors mistakenly assume that risk and uncertainty are the same. They aren’t.

Before making any decision, you must classify the environment you’re dealing with.

To understand this, let’s examine a simple but powerful decision-model.

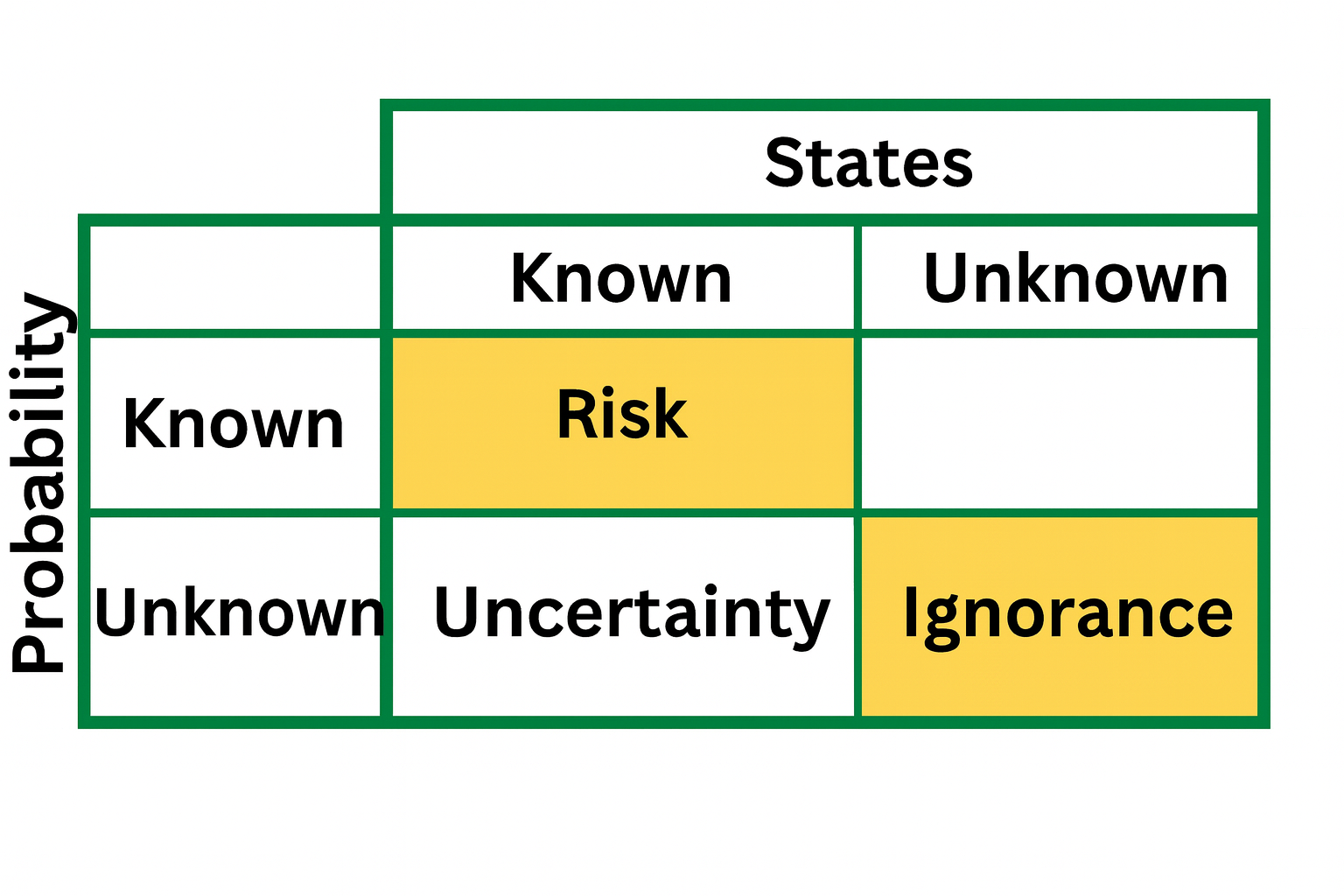

The Decision-Model Table

This model categorizes decisions based on two dimensions:

A) Probability

-

Known: Can estimate probabilities

-

Unknown: Cannot estimate probabilities

B) States (Outcomes)

-

Known: Possible outcomes are identifiable

-

Unknown: Outcomes cannot be defined clearly

Combined, they create four decision environments:

Decision-Model Table: Probability vs States

How to Read the Table

1️⃣ Known Probability + Known Outcomes → Risk

You can estimate future states and assign probabilities.

2️⃣ Known Outcomes + Unknown Probability → Uncertainty

You know the outcomes, but can’t assign probabilities.

3️⃣ Unknown Outcomes + Unknown Probability → Ignorance

You don’t know the outcomes nor the probabilities.

This is the most dangerous zone.

Understanding “Risk” Through an Investment Example

Risk falls under “known known”:

You understand the possible outcomes and can estimate the probabilities.

Example:

A finance company evaluating loan applicants.

Possible outcomes:

-

The borrower repays

-

The borrower defaults

Probabilities:

-

Repayment probability estimated from income, assets, past credit behavior

-

Default probability estimated from debt history, recurring income, and financial stability

Because both outcomes and probabilities can be estimated, this is a risky situation — not an uncertain one.

This is why banking is a risky industry, not an uncertain industry.

Understanding “Uncertainty” With Insurance

Uncertainty falls under “unknown known”:

You know what might happen, but cannot estimate the probability.

Example:

Life insurance.

Possible states:

-

Accidents

-

Illness

-

Sudden death

But the probabilities of these rare events cannot be meaningfully calculated.

This is why insurance is an uncertainty-based industry, not a risky one.

In short:

-

Risk can be estimated and managed.

-

Uncertainty cannot be estimated or controlled fully.

How Emotions and Biases Distort Investment Decisions

Even after classifying decisions properly, humans fall prey to heuristics — mental shortcuts meant to save time but often leading to systematic errors.

These shortcuts introduce behavioral biases that quietly damage decision quality.

Great investors aren’t emotionless —

they’re aware of how emotions influence them.

Let’s explore the three most influential biases.

A) Overconfidence Bias

We often overestimate our ability to predict outcomes.

We prefer the outcome we want to happen, instead of listing all probable outcomes.

This bias traps investors in an illusion of control — believing they influence something they actually don’t.

How to overcome:

-

Be conservative

-

Be open-minded

-

Question your assumptions deeply

Simple — but not easy.

B) Confirmation Bias

Once we form a decision, we look only for information that supports it.

We ignore data that contradicts our belief.

This is why investors defend bad decisions emotionally.

How to overcome:

Do the exact opposite — actively search for information that disconfirms your assumption.

This alone drastically improves decision quality.

C) Recency Bias

We give too much importance to recent events:

-

After a few winning trades → we feel invincible

-

After a few losing trades → we doubt our capability

This bias creates emotional volatility that affects rational judgment.

How to overcome:

Treat every decision as independent.

Past results don’t guarantee future outcomes — either positive or negative.

Decision-Making Is a Battle With Your Own Biases

Improving the investment decision making process is not about reading more or analyzing more.

It is about practicing better mental habits — again and again.

Decision making is a discipline, not an event.

You must:

-

Understand your biases

-

Build frameworks

-

Think probabilistically

-

Avoid emotional shortcuts

This journey is challenging — but the reward is extraordinary.

Clear thinking compounds just like money does.

This blog lays the foundation.

In the upcoming post, we will dive deeper into the Mental Models every serious investor must learn to survive the complex, uncertain world of financial markets.