When to invest in Stock Market?

Stock market consists of libraries of stories ranging from, a man getting from rags to riches and riches to rags. The main problem with investors is not that, they want to become rich in the stock market but rather they want to become rich quickly. Everyone likes to get rich quickly in the stock market but the markets are not designed in that way. The market will test our patience to its core before rewarding with fruitful money. The main ingredient to become rich in the stock market is to start early.

Power of being early in the game

Tina and Bina are two best friends from their school days. Both have started their career at age of 25 by earning a modest salary of Rs 20000 per month. Tina being wise, decides to invest Rs 6000 every month (yearly investments of Rs 72000) in the stock market. She continues for just 10 years and then she stops investing her money. She expects a modest return of 15% every year to her portfolio.

Bina at the age of 35, now decided to invest in the stock market. She also decides to invest Rs 6000 every month regularly. Bina invests her money for the next 25 years and she still continues to invest regularly.

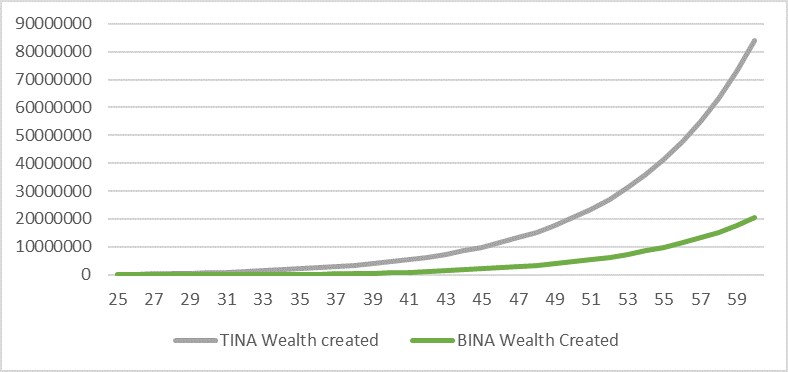

Whom do you think will be more wealth in long run?

It would be Tina. Yes, you read it right, the girl who invested for just 10 years will be wealthier and even multiple times wealthy than the girl who has invested for 25 years and still investing.

But the most important fact is that Bina would never in her lifetime (even if she invests for additional 20 years) would catch up with the wealth created by Tina. But why so?

That’s the power of being early in the game. Compounding of our money shows its beauty when we start early.

|

TINA |

||||

| Age | Investment years | Yearly SIP Amount | Cumulative SIP amount | Year-end SIP amount |

| 25 | 1 | 72000 | 72000 | 82800 |

| 26 | 2 | 72000 | 154800 | 178020 |

| 27 | 3 | 72000 | 250020 | 287523 |

| 28 | 4 | 72000 | 359523 | 413451 |

| 29 | 5 | 72000 | 485451 | 558269 |

| 30 | 6 | 72000 | 630269 | 724810 |

| 31 | 7 | 72000 | 796810 | 916331 |

| 32 | 8 | 72000 | 988331 | 1136581 |

| 33 | 9 | 72000 | 1208581 | 1389868 |

| 34 | 10 | 72000 | 1461868 | 1681148 |

From the table we get that, Tina has generated a wealth of Rs 16.8 lakhs by investing Rs 7.2 lakhs in 10 years.

Now we compare the wealth created by both Tina and Bina and understand the real power of compounding over a long run from the below table.

| Age | TINA | BINA | ||

| Amount Invested | Wealth created | Amount Invested | Wealth Created | |

| 25 | 72,000 | 82,800 | – | – |

| 26 | 72,000 | 1,78,020 | – | – |

| 27 | 72,000 | 2,87,523 | – | – |

| 28 | 72,000 | 4,13,451 | – | – |

| 29 | 72,000 | 5,58,269 | – | – |

| 30 | 72,000 | 7,24,810 | – | – |

| 31 | 72,000 | 9,16,331 | – | – |

| 32 | 72,000 | 11,36,581 | – | – |

| 33 | 72,000 | 13,89,868 | – | – |

| 34 | 72,000 | 16,81,148 | – | – |

| 35 | – | 20,16,120 | 72,000 | 82,800 |

| 36 | – | 24,01,338 | 72,000 | 1,78,020 |

| 37 | – | 28,44,339 | 72,000 | 2,87,523 |

| 38 | – | 33,53,790 | 72,000 | 4,13,451 |

| 39 | – | 39,39,658 | 72,000 | 5,58,269 |

| 40 | – | 46,13,407 | 72,000 | 7,24,810 |

| 41 | – | 53,88,218 | 72,000 | 9,16,331 |

| 42 | – | 62,79,250 | 72,000 | 11,36,581 |

| 43 | – | 73,03,938 | 72,000 | 13,89,868 |

| 44 | – | 84,82,329 | 72,000 | 16,81,148 |

| 45 | – | 98,37,478 | 72,000 | 20,16,120 |

| 46 | – | 1,13,95,900 | 72,000 | 24,01,338 |

| 47 | – | 1,31,88,085 | 72,000 | 28,44,339 |

| 48 | – | 1,52,49,097 | 72,000 | 33,53,790 |

| 49 | – | 1,76,19,262 | 72,000 | 39,39,658 |

| 50 | – | 2,03,44,951 | 72,000 | 46,13,407 |

| 51 | – | 2,34,79,494 | 72,000 | 53,88,218 |

| 52 | – | 2,70,84,218 | 72,000 | 62,79,250 |

| 53 | – | 3,12,29,651 | 72,000 | 73,03,938 |

| 54 | – | 3,59,96,898 | 72,000 | 84,82,329 |

| 55 | – | 4,14,79,233 | 72,000 | 98,37,478 |

| 56 | – | 4,77,83,918 | 72,000 | 1,13,95,900 |

| 57 | – | 5,50,34,305 | 72,000 | 1,31,88,085 |

| 58 | – | 6,33,72,251 | 72,000 | 1,52,49,097 |

| 59 | – | 7,29,60,889 | 72,000 | 1,76,19,262 |

| 60 | – | 8,39,87,822 | 72,000 | 2,03,44,951 |

The above table simply tells us that, the girl who invested only Rs 7.2 lakhs has created a wealth of 8.3 crores at the age of 60. Another girl who invested Rs 18 lakhs and still investing has created a wealth of Rs 2 crores only. The secret for the huge differences is that, the first girl stated early.

However hard Bina tries, she would not be able to match up with the wealth of Tina, even if she continues to invest for many years to come.

Wealth Creation Chart

But what if I didn’t start in my early years, what is the right time to start my investments?

The present moment is the best time to start our investments. Don’t bother about the present market environment. The big news which is ruling the markets today (trade war, rupee depreciation, political uncertainty etc.) will ultimately fade in just a few years. If you don’t believe me, just try to remember what was the hot news of the day exactly one or two years before, the news must have died long ago. We should not be like Bina and try to act like Tina by being early in the game.

When asked Warren Buffet, what was his greatest regret?

Now we can understand why Warren Buffet is enormously wealthy. Power of compounding worked in his favor by being early in the game.