Intraday Trading Vs Swing Trading: Which Is Really Better?

Being a stock trader you need to know your trading style. This helps you to adopt the right trading methodology. Stock selection, holding period, exit strategy and the trading instruments are different for intraday trading and swing trading. Here i have decided to write the pros and cons of both the trading formats and you decide and let me know which suits you.

Being a stock trader you need to know your trading style. This helps you to adopt the right trading methodology. Stock selection, holding period, exit strategy and the trading instruments are different for intraday trading and swing trading. Here i have decided to write the pros and cons of both the trading formats and you decide and let me know which suits you.

What is Intraday Trading?

Any trade which is exited within a day is qualified as intraday trading. This includes both long as well as short positions. It can be executed in cash market as well as in derivative market such as futures and option.

What is Swing Trading?

Any trade with a holding period of 5 to 10 days is qualified as swing trading, this can be otherwise called as positional trading or delivery trading. Short position can be created only on derivative segment.

The primary difference is the duration. But the trader can consider some more factors while choosing between intraday and swing trading.

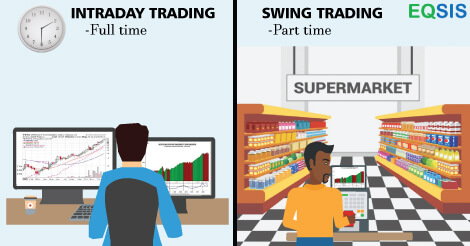

Full time vs. Part-time profession.

Intraday trading needs your full time presence between 9:00Am to 3:30Pm from Monday to Friday. Generally the real time analyses are followed to identify the momentum of stocks. You cannot decide the stocks to trade for intraday in a day advance. It is not that every day is profitable, but if you follow some logical steps you may have net profits over a period of time. Hence intraday trader should be available in the market over a period of time.

Swing traders can carry out their analysis by end of the day; it may not require the trader’s presence throughout the market hours. You need the market access only to execute the order.

Stock Selection criteria.

Intraday traders need to be really fast and spontaneous to the change of market trend. The key macro data and other announcement may drive the market for a short while. Hence the risk tolerance level should be balanced according to the market volatility. The intraday price moves are not driven by the actual company performance, rather it is driven by market sentiment. So the stock selection for intraday trading is based on global market performance, sectors which drive the market and spot the stock with volume indication.

Swing traders follow short term trend, by deriving the demand and supply by following the price and volume. The concepts such as Dow Theory, Price Patterns and Candlesticks are use to understand the current market trend. Many swing traders also use the technical indicators and line studies to gauge the price trend. The market news and other events are discounted by the market; hence technical trader can ignore news and other events, simply stick to price and volume and decide the stocks to trade.

Emotional control.

Success in stock trading is largely dependent on emotion behavior. It involves lots of decision making, so one should learn to take rational decisions i.e. without fear and greed. This can be achieved by practicing technical analysis over a period of time.

Intraday traders should have significant tolerance level. You may experience failures and success; this may excite you or may disturb you. Both these emotions are not good for traders. Trading exposure is generally provided for intraday, but it increases risk to the capital. Hence it may influence the trading decision emotionally.

Swing traders are comfortable in handling their emotions as they select stocks in no hurry. Moreover the execution and decision making (analysis) are at two different times. Hence even novice traders may fine positional trading comfortable.

Infrastructure.

Right from selection of stock brokers, research tools, and access to market information everything is different for intraday and swing traders.

Intraday traders needs low brokerage account as the trading volume is high and they are expected to turnaround their positions very often. The Real time data are generally expensive and it is inevitable to track markets closely. They have to be well connected to the market news.

Positional traders generally use the daily charts which is available at free of cost from various sources. Stock EOD Charts for positional traders to study the charts and take rational trading decisions. Instead of real time filter they need EOD scanner to filter out stocks with momentum. The cost to carry out analysis is generally low and it can be done at their convenience.

Investments.

The returns are directly proportionate to the amount of investment you make. Meanwhile the risk is expected to increase along with the increase in capital.

Intraday traders need less trading capital to start trading, as they get some leverage from the broker. The cost of intraday training is also low when compared to swing trading in cash segment.

Swing traders need a sizable capital to get decent returns, but they can use futures and option to leverage their trades accordingly. Trade diversification and money management concept is very important to achieve profits in long run.

To conclude.

If you are choosing stock trading as your career then intraday trading should be chosen. If you are trading to earn some extra income then positional trading can be chosen. For both the trading styles in-depth knowledge about stock trading is must to avoid losses. EQSIS provides professional stock trading and analysis training which will help you succeed in stock market.