[fusion_builder_container background_color=”” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”” padding_top=”20″ padding_bottom=”20″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

How to transfer shares to an another demat account?

[/fusion_text][fusion_text]

Terms to understand

[/fusion_text][fusion_text]

- DIS – Delivery Instruction Slip is used when shares are to be transferred from one demat account to another demat account.

- Demat account- It is a place where all the physical forms such as share certificates, mutual fund investments, and bonds are converted into electronic form.

- To open a demat account visit a nearby Depository Participant.

- DP- Depository Participant– A broker who is licensed under SEBI (Securities and Exchange Board of India) and depositories

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

Depositories in India:

[/fusion_text][fusion_text]

- NSDL- National Securities Depository Limited– (NSDL) preferred partner of National Stock Exchange (NSE)

- CDSL- Central Depository Services Limited– (CDSL) prefered partner of Bombay Stock Exchange (BSE).

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

Types of demat transfer

[/fusion_text][fusion_text]

- Intra Depository Transfer (Off Market Transfer) – If securities are transferred from the Current to New brokers attached to the Same Depositories.( Either both NSDL or both CDSL).

- Inter Depository Transfer- If securities are transferred from the Current to New brokers attached to Different Depositories.( One with NSDL or any other and the other with CDSL or vice versa)

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

Abbreviations

[/fusion_text][fusion_text]

- ISIN – (International Securities Identification Number): A Particular Share/Security of a company have respective ISINs containing 12 digit number starting with IN. Various securities issued by Issuer/Company have different ISINs.

- DP ID: Depository Participant ID – It’s the broker’s ID where one currently holds the demat account.

- BO : Beneficiary Owner (Demat Account Holder).

- CM : Clearing Member (Broker Pool Account).

- CM ID: Clearing Member ID no.

- CMBP ID : Clearing Member Broker Pool ID.

- Counter DP ID: Depository Participant ID of demat account where the shares getting transferred.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

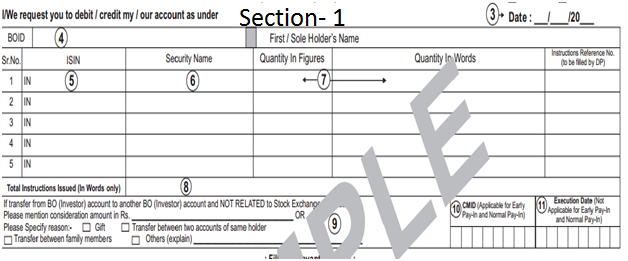

Sample DIS slip- Section 1

[/fusion_text][fusion_imageframe image_id=”” style_type=”none” stylecolor=”” hover_type=”zoomin” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”none” lightbox=”no” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]  [/fusion_imageframe][fusion_separator style_type=”none” top_margin=”” bottom_margin=”” sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=”” /][fusion_text]

[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”” bottom_margin=”” sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”” class=”” id=”” /][fusion_text]

- Depository Name

- Depository participant Name

- Date should be the same or earlier from the “Execution Date”. Future date in this column will not be accepted.

- Client Name and A/c No

- Specify ISIN

- Name of the Security to be transferred

- Specify the quantity in figures as well in words

- Specify the total no. of ISINs to be delivered in words. This is required to safeguard against unauthorized alteration. Strike out the unused space for ISINs.

- Fill this if only transfer b/w BO is NOT RELATED TO Stock Exchange transactions.

- Specify the CM ID (Clearing Member ID) of the broker to whose pool account securities are to be transferred.

- Specify the Execution date on which the securities are to be transferred. Submit the DIS request well in advance to avoid failure in execution.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

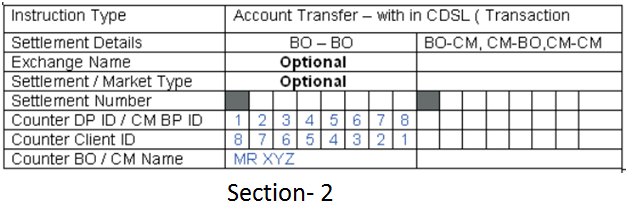

Sample DIS slip- Section 2

[/fusion_text][fusion_imageframe image_id=”” style_type=”none” stylecolor=”” hover_type=”zoomin” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”none” lightbox=”no” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]  [/fusion_imageframe][fusion_text]

[/fusion_imageframe][fusion_text]

- From one beneficiary owner (BO) to another beneficiary owner (BO).

- Fill the 8 digit number under Counter DP/CM BP ID.

- Fill your name under Counter BO/CM Name.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

Steps to transfer shares from one demat account to another.

[/fusion_text][fusion_text]

- Fill up the DIS slip as explained above.

- Ensure all the fields are correct, especially the target client ID.

- Submit the duly filled DIS to your Current Broker.

- Make sure you receive the acknowledgement from the current Broker.

- Separate DIS is to be filled for transferring shares to different demat accounts.

- If the DIS is complete in all respect, then acknowledgement of the DP should be given to the BO.

- Date of receiving the DIS should be written on the acknowledgement given to the BO.

- All corrections on the DIS must be duly authenticated by the account holder (s) by affixing his/her signature near the place of the correction.

- All signatures must be done using a ballpoint pen or an ink pen only. Sketch pens and marker pens should not be used for signing.

- Use of whiteners / correction fluids anywhere on the DIS form must be avoided in entirety.

- Ensure that the client has sufficient amount of credit balance in his account before accepting the DIS. The charges for per ISIN are as applicable DP tariff assigned to the client.

- The normal charges are : 0.04% of the value Rs. 30.00 per ISIN whichever is higher plus applicable Service Tax (Current rate being 12.36% on DP Charges) Depository Participant ID.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

To conclude

[/fusion_text][fusion_text]

Many people find it very difficult or confusing to transfer shares from one demat account to the other. This process is a very simple all you need is knowledge and awareness. Read this blog as this will help you to solve all the doubts regarding transferring shares to one demat account to another.

Comment you doubts and/or views below.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]