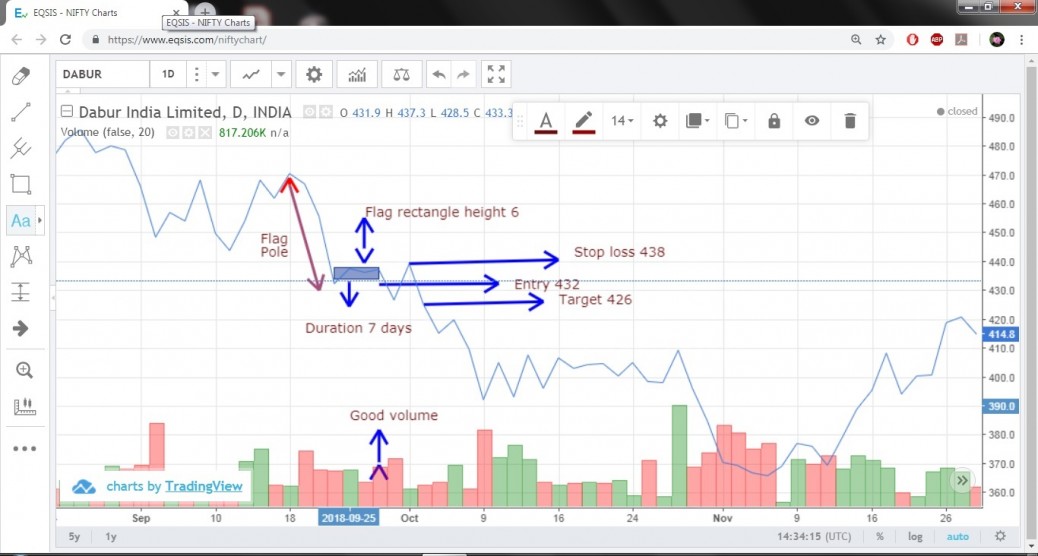

Flag formation is a steep pole with an attached rectangle and again a steep movement in the same direction of the pole. For bearish pattern, we have an inverted flag, in which the pole steeps downwards and forms a small rectangle and again steeps downwards. Height of the rectangle should be measured. The place where the rectangle ends and starts steeping again is the breakout. Entry should be on or above the breakout. Target is entry – height of the rectangle. Stop loss is entry + ht of the rectangle.

The breakout volume is not good

Thanks for the feedback. I have a doubt.The flag rectangle formation started on 25-9-18 and ended on 28-9-18. The same day itself it has started breaking out. I admit that the volume is not exceptional on that day, but it was quite good. So I thought entry could be placed there. From the next market day, Oct 1st volume became low. But the downtrend (even after a small jolt) has survived.

What will be your advice? To trade or not to trade?

I ask questions because I want to learn and be sure. No offense.