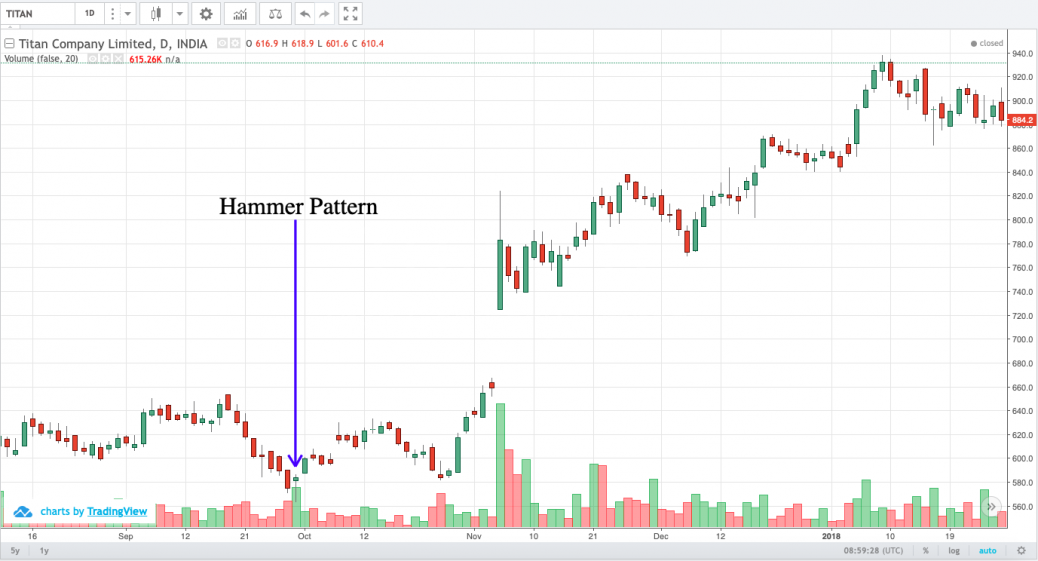

A Hammer/ Hanging man pattern signals a potential reversal. But taking a decision solely on the basis of this pattern is very risky. All it confirms is that market sentiment could be changing. The candle has a small real body and a long lower shadow. While Hammer occurs after a downtrend and may signify an oncoming uptrend, A Hanging Man occurs at the peak of an uptrend and may signal an oncoming downtrend. For traders willing to risk on seeing a hammer, it is an opportunity to enter into a long position or exit a short position.