@vivekanand-ananthgmail-com

-

wesley and

vivekanand are now friends 7 years, 10 months ago

vivekanand are now friends 7 years, 10 months ago -

vicky and

vivekanand are now friends 7 years, 10 months ago

vivekanand are now friends 7 years, 10 months ago -

Deepika Nautiyal and

vivekanand are now friends 7 years, 10 months ago

vivekanand are now friends 7 years, 10 months ago -

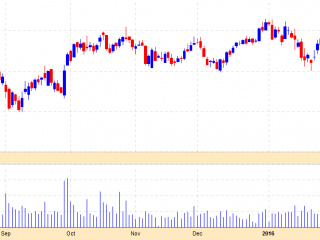

vivekanand posted an update 7 years, 10 months ago

I am going to Short Airtel tomorrow for day trading. Lets see what happens. Reason Double top formation.

-

vivekanand posted an update 8 years ago

Eqsis, any update to my earlier question on F&O and Stock chart difference. Which chart is considered superior and which one will over ride the other.

-

vivekanand posted an update 8 years ago

Happy Mahaveer Jayanthi. Another holiday for market. One small query for Eqsis. In case if bearish engulfing is formed in F&O chart and bearish engulfing is not formed in CMP chart then which one can be considered. Vice versa if bearish engulfing is formed in CMP chart and not formed in F&O chart then which one to follow. The chart to be followed…[Read more]

-

vivekanand posted a new activity comment 8 years ago

This is operator controlled stock. Don’t enter this.

-

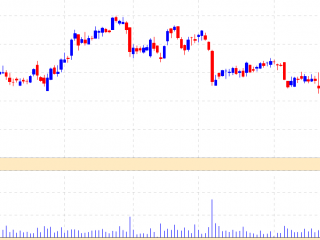

vivekanand posted an update 8 years ago

The run of just dial is over. when the market is 400 points up it is up only 1% (i.e) 8 rs. hence, it is awaiting for huge fall. also its future price is always below its last traded price and had not shown strength. hence, just dial is waiting for huge fall. shorters can enter. longers can exit.

-

vivekanand posted an update 8 years ago

Hello, most of the person who do trading quit after making loss. Only bad experiences teaches everything. Only when you get into the cricket ground you can score runs. With fear of getting hit by ball or getting hurt by falling down, if you don’t enter the ground, you cannot play the game. Only when you get out you can learn from the mistake and y…[Read more]

-

vivekanand posted an update 8 years ago

Hello friends, have you seen any one becoming rich by trading? No….. People become rich only by the portfolio they built. Have any one become rich by buying all the blue chip companies in their portfolio? No. Blue chip companies are meant for MF, DII, FII & Pension funds. These funds are interested in blue chip companies because of the dividend t…[Read more]

-

vivekanand posted an update 8 years ago

Volume is very important along with price. But, who creates increase and decrease in the volume. Normal retail investors like you and me? No. Big institutional investors, FII, DII and High net worth individuals (NHI) like rakesh junjunwala. Because even though they do any thing in small,l the quantities and the money involved is more. So all of…[Read more]

-

vivekanand posted an update 8 years ago

Ceat has formed based @ 1100. Within next 6-12 months it will cross its 52 week high. Target 1200-1300 & above. Good for positional holders. Good volume. Also ceat has made agreement with skoda to fit its tyres in all its new cars along with one spare. So price increase is anticipated and volume suggest the same. There might be short down ward…[Read more]

-

vivekanand posted an update 8 years ago

Wipro jumped up because of share buy back plans. Most likely the buy back value will be less when compared to the market price. So Wipro is a sell. Max it can reach 600 then come down and settle in its comfort level of 550.

-

vivekanand posted an update 8 years ago

DHFL (Dewan Housing) is showing signs of recovery like lic housing fin, m&m finance. All the finance companies are in up trend. International investors are allowed to invest in Indian private financial companies. Good buy for positional holders and investors. Buy on dips. Soon to touch 225-250-275 within 6-12 months. Volume is also improved.

-

vivekanand posted an update 8 years ago

NTPC formed based arounf 125. Price is going up with good volume. Seem to touch 140 and make new 52 week highs in the coming year. Modi’s last 3 year will be good doing good to indian business concentrating on the up coming elections. All govt. companies to do well. So NTPC is a buy for positional holders.

-

vivekanand posted an update 8 years ago

Kaveri seed has formed based and moving up. All monsoon related stocks are doing well. So buy on dips and hold for long term. Target is 500-600-700-800. It is the only indian seed company competing with MNC’s like Monsanto. Monsanto has filed a suit against kaveri seed and other organic companies to pay royalty. Indian govt. ruled out the case…[Read more]

-

vivekanand posted an update 8 years ago

Lic housing finance is nearing its 52 week high. Good for positional holders. Results will create impact and the results seem to be positive. Buy on dips. Will cross 500-525-550 in the coming 6-12 months. There will be a short downward drift giving opportunities to buy and hold for long term.

-

vivekanand posted an update 8 years ago

IFCI is in the process of forming CUP and handle formation. While forming handle it will slide down slowly. Then it will reach 27.75. Even 2 rs. profit per share in this kind of small price share will give huge return. Don’t buy at one stretch. Buy on dips then average. Good for positional holders.

-

vivekanand posted an update 8 years ago

ITC is forming base at around 320 levels. It will cross its 52 week high of 360 and is good for positional holders. Volume is also consistently good. ITC has decided not to stop cigarette manufacturing and resumed its cigarette manufacturing factories operations. So its a buy.

-

vivekanand posted an update 8 years ago

Bajaj auto is nearing its 52 week high. Good for positional holders. Like Mahindra buy on dips. Expect to make new 52 week high within next 1 year. The entire 2 wheeler segment looks good with Bajaj auto having edge.

- Load More

airtel

airtel just dial

just dial wipro

wipro dhfl

dhfl ntpc

ntpc lichousing

lichousing ifci

ifci itc

itc bajaj auto

bajaj auto